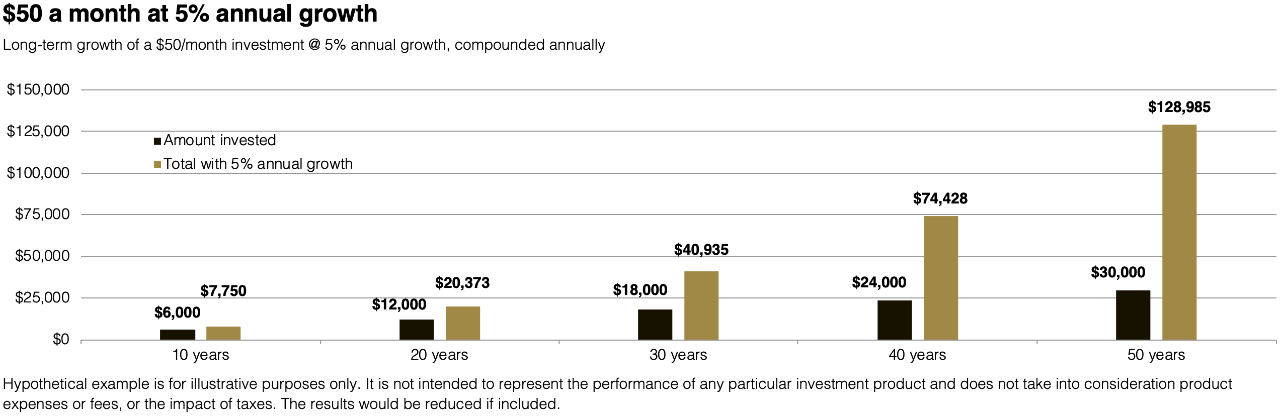

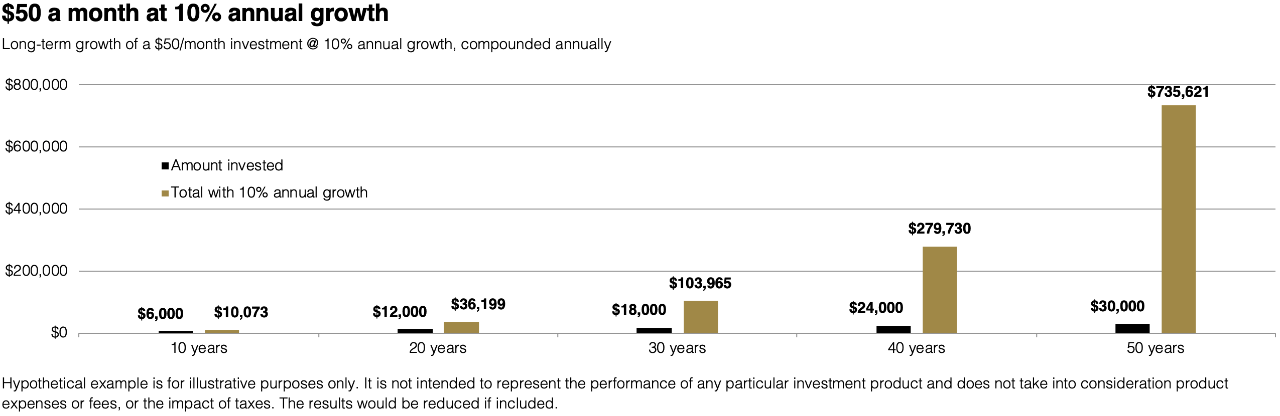

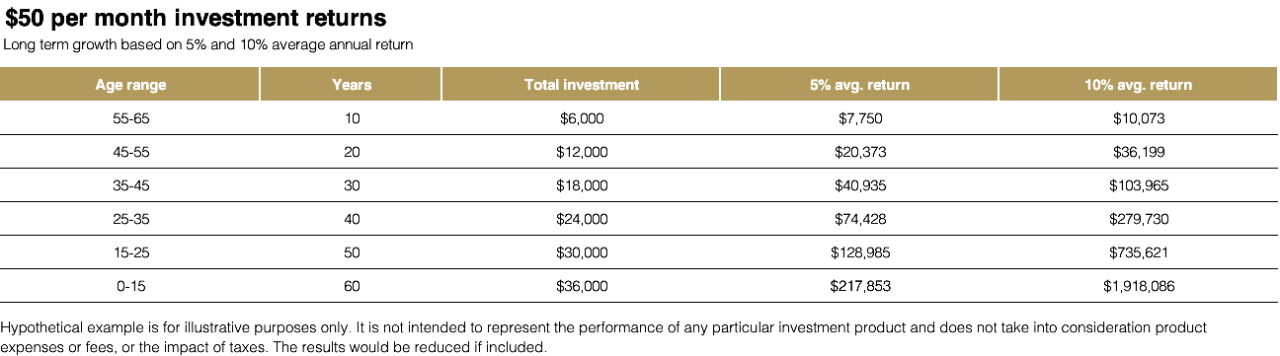

A more aggressive investment may provide an even higher return than the 5% shown above. For example, we can look at an average return closer to the S&P 500® Index (a market-cap-weighted index that represents the average performance of a group of 500 large cap stocks.)

From 1974 through 2024, the S&P 500 grew at an average annual rate of 9.7%2. While it’s important to note that past performance does not guarantee future returns, let’s say that after the investment's expenses and fees, you are able to earn an average return of 10% per year.

In this example with a 10% return, you’ll see that the same $50-per-month investment quickly grows to an even more meaningful amount over time if it is earning a higher percentage of annual growth, and 10% may not be an unreasonable expectation based on the average history of the S&P 500® Index. Keep in mind that achieving this average rate of return will, however, depend on the performance of the funds you select for your investment and being invested for the long term.