Asset allocation fund choices

Thrivent Mutual Funds offers six different asset allocation funds that range from conservative to aggressive. Although each of the funds has an asset allocation target, the actual allocation can vary depending on the outlook and judgment of the fund managers. The funds are actively managed by a team of more than 140 investment professionals.

For example, Thrivent Moderately Aggressive Allocation Fund (TMAFX) has a target asset allocation of 80% equity securities and 20% fixed income securities, but the actual allocation typically varies somewhat as the fund manager makes adjustments in the holdings to react to changing market and economic conditions.

This Fund typically invests in more than a dozen different asset groups. The largest group is domestic large-cap stocks, which typically accounts for over a third of the Fund’s total assets. The Fund also invests in several other equity groups, including international, small-cap and mid-cap. Bonds and other debt instruments make up the balance of portfolio assets, led by U.S. government bonds, securitized debt, investment grade corporates and cash. Other bond instruments include leveraged loans, international government bonds and flexible income.

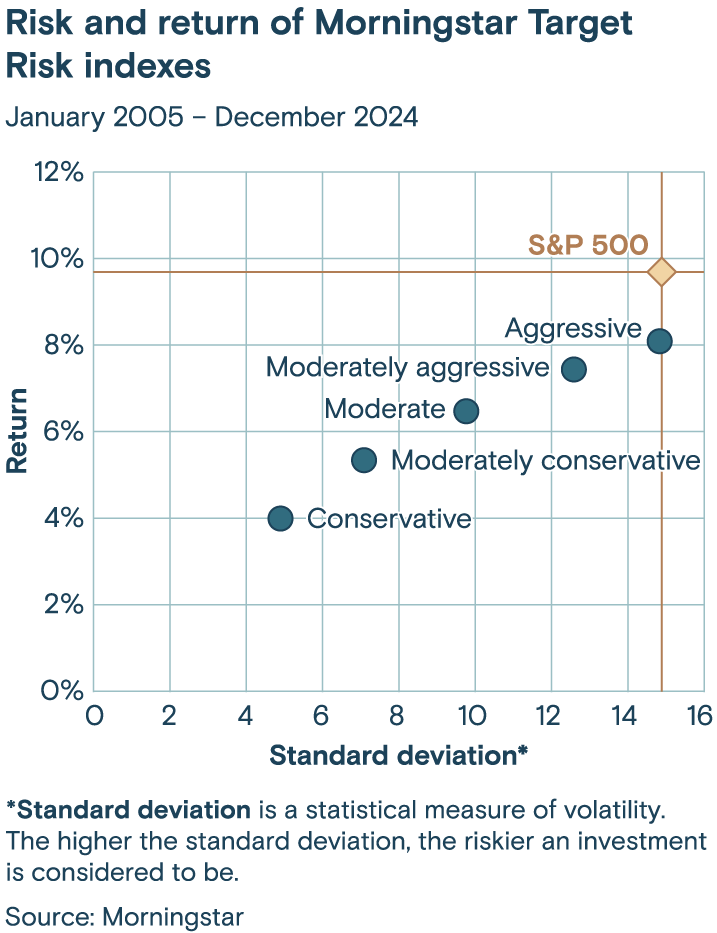

The diversification of these asset allocation funds makes them less volatile than the performance of a single equity category, such as a fund that invests primarily in mid-cap stocks. Although the more conservative portfolios would tend to have lower potential returns over the long term, their losses tend to be more modest and less frequent than the more aggressive investments, and they tend to have lower volatility.

Gauging relative volatility and risk

To gauge relative volatility, investors often use a metric known as beta. Beta is a statistical measure of the volatility, or market risk, of an investment compared to a benchmark. The lower the beta, the lower the volatility of the investment compared with the benchmark.

The S&P 500 Index is considered a beta baseline, with a beta of 1.0. Anything over 1.0 is considered more volatile or risky than the market and anything under 1.0 is considered less volatile and less risky. For example, over a recent three-year period through March 30, 2025, Thrivent Moderately Aggressive Allocation Fund – Class S had a beta of 0.83, which indicated that it was 17% less volatile than the S&P 500 Index during that period.

In addition to the Thrivent Moderately Aggressive Allocation Fund, Thrivent also manages five other asset allocation funds, giving investors with conservative to aggressive risk tolerances the opportunity to choose a portfolio suited to their objectives and threshold for risk:

- Thrivent Conservative Allocation Fund (THYFX). For investors looking for a moderately conservative risk tolerance, this Fund’s target allocation is 80% in fixed income securities and 20% of assets in equity securities. While this fund would probably trail the market and the other Thrivent Asset Management asset allocation funds during a strong bull market, it would typically be the least volatile, with the lowest risk, during rocky periods in the market. Over a recent three-year period through March 30, 2025, the Thrivent Conservative Allocation Fund – Class S has had the lowest beta of the group at 0.47, which indicates that it was 53% less volatile than the S&P 500 Index.

- Thrivent Moderately Conservative Allocation Fund (TCAIX). The target allocation for this fund is 57% fixed income securities and 43% equity securities. Over a recent three-year period through March 30, 2025, the Thrivent Moderately Conservative Allocation Fund – Class S has a a beta of 0.58, which indicates that it was 42% less volatile than the S&P 500 Index.

- Thrivent Dynamic Allocation Fund (IBBFX). For investors looking for a middle of the line approach, this Fund’s target allocation is 55% in fixed income securities and 45% in equity securities. Over a recent three-year period through March 30, 2025, the Thrivent Dynamic Allocation Fund – Class S has a beta of 0.57, which indicates that it was 43% less volatile than the S&P 500 Index.

- Thrivent Moderate Allocation Fund (TMAIX). This Fund’s target allocation is 65% of assets in equity securities and 35% in fixed income securities. Over the recent three-year period through March 30, 2025, the Thrivent Moderate Allocation Fund – Class S had a beta of 0.74, which indicates that it was 26% less volatile than the S&P 500 Index.

- Thrivent Aggressive Allocation Fund (TAAIX). This Fund is geared to investors who want most of their assets in the stock market, but still prefer some diversification to offset the volatility of the market. The target allocation of the fund is 95% of assets in equity securities and 5% in fixed income securities. Over a recent three-year period through March 30, 2025, the Thrivent Aggressive Allocation Fund – Class S had the highest beta of the asset allocation fund group at 0.93, which indicated that it was 7% less volatile than the S&P 500 Index.

Thrivent Asset Management has more than 20 mutual funds and exchange-traded funds spanning most major asset classes to help investors build diversified portfolios.

Although asset allocation funds cannot shelter you entirely from the ups and downs of the market, they can lower your exposure to the stock market and help reduce the volatility of your own portfolio over the long-term.

Learn more about Thrivent Asset Allocation Funds.

![January 2026 Thrivent market & economic update [VIDEO]](/content/dam/thrivent/mcs/site-media/insights/market-update/2026-q1-thrivent-market-and-economic-update/2026-q1-group-thumbnail.png/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)