A traditional individual retirement account (IRA) is a retirement savings account that allows you to potentially reduce your taxes in the current tax year while building your retirement savings tax-deferred. If you’re not currently funding an IRA, you may be short-changing yourself both now and in the future.

Advantages of a traditional IRA

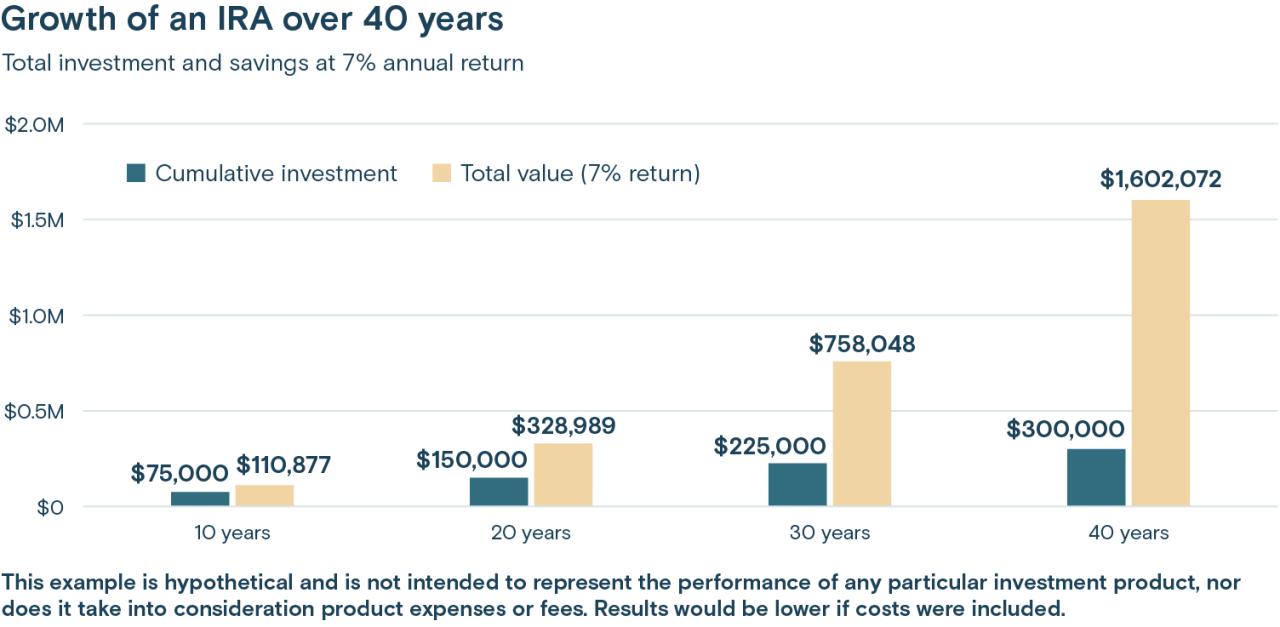

When you contribute to a traditional IRA, every qualified IRA investment dollar you add to your account may reduce your taxable income by the same amount. If you contribute the maximum amount each year, which is $7,000 for an individual under 50 and $8,000 for people 50 and over in 2025 and $7,500 ($8,600 for 50 and up) for 2026, you may be able to reduce your taxable income by that same amount.

For example, if you’re in the 25% tax bracket, a $7,500 contribution could save you about $1,875 in taxes. If you’re in the 10% bracket, it could save you about $750.

Note that your tax deduction may be limited due to your income and other factors such as your or your spouse’s ability to participate in an employer-sponsored retirement plan such as a 401(k). See details on deductions and contribution limits.