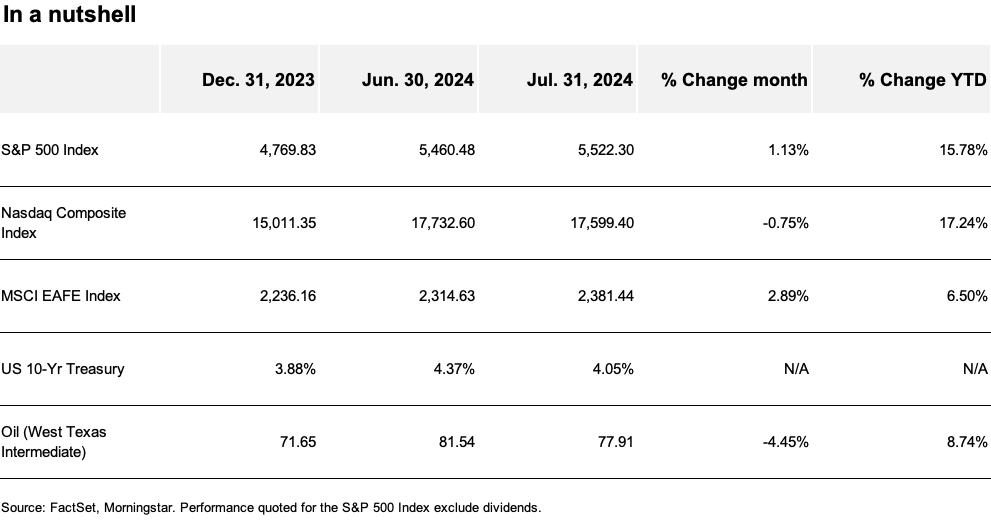

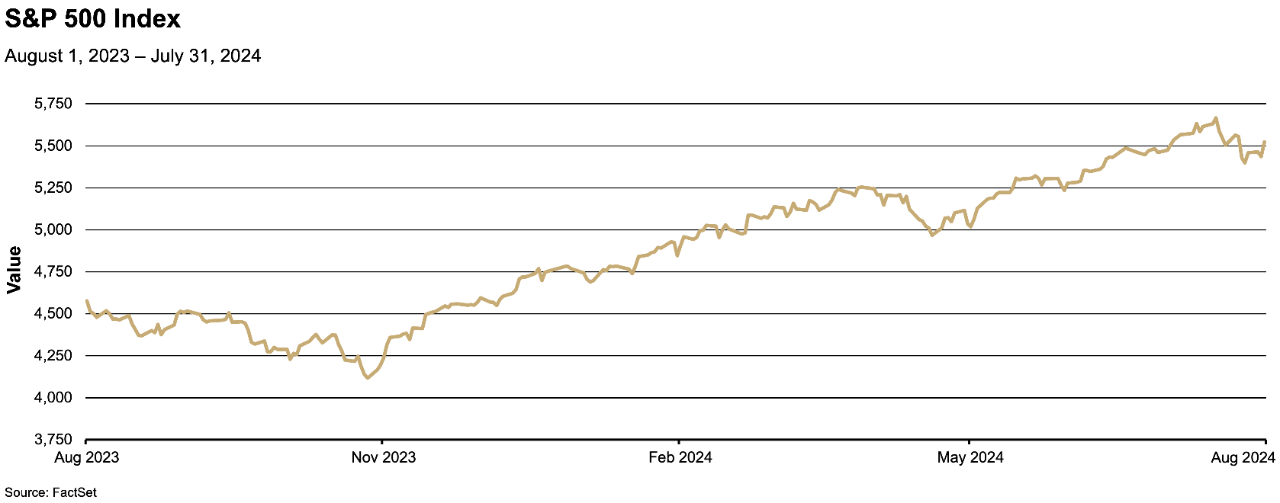

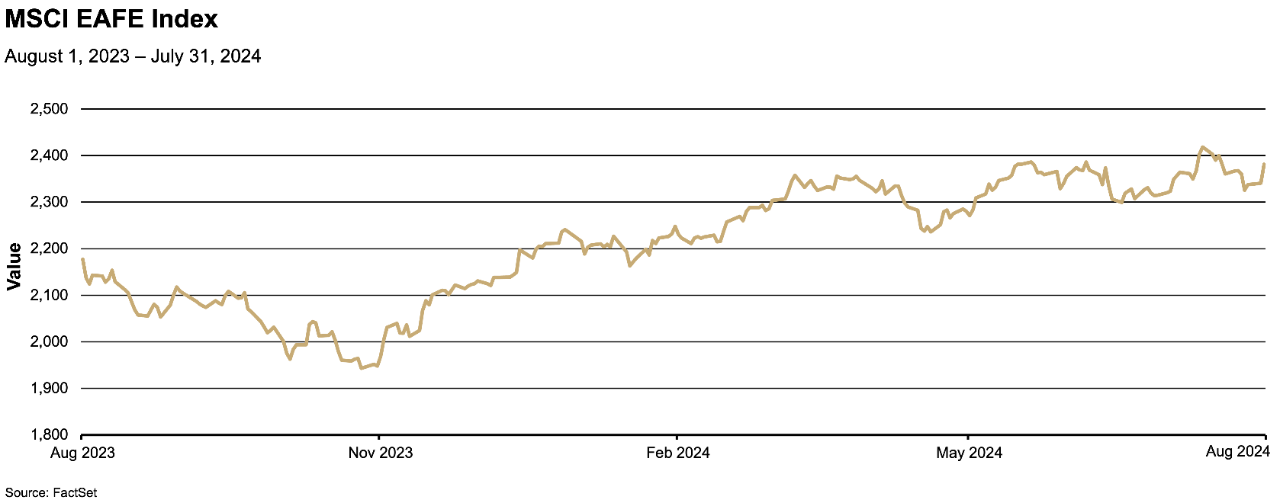

Uncertainty and volatility rose in July, fueling a correction in stocks that gathered steam into August. The recent stock market volatility was not unexpected given the significant run up in the markets from the beginning of the year resulting in relatively rich valuations. For instance, the so-called Magnificent Seven group of mostly large technology stocks peaked with a year-to-date return of greater than 50% in mid-July.

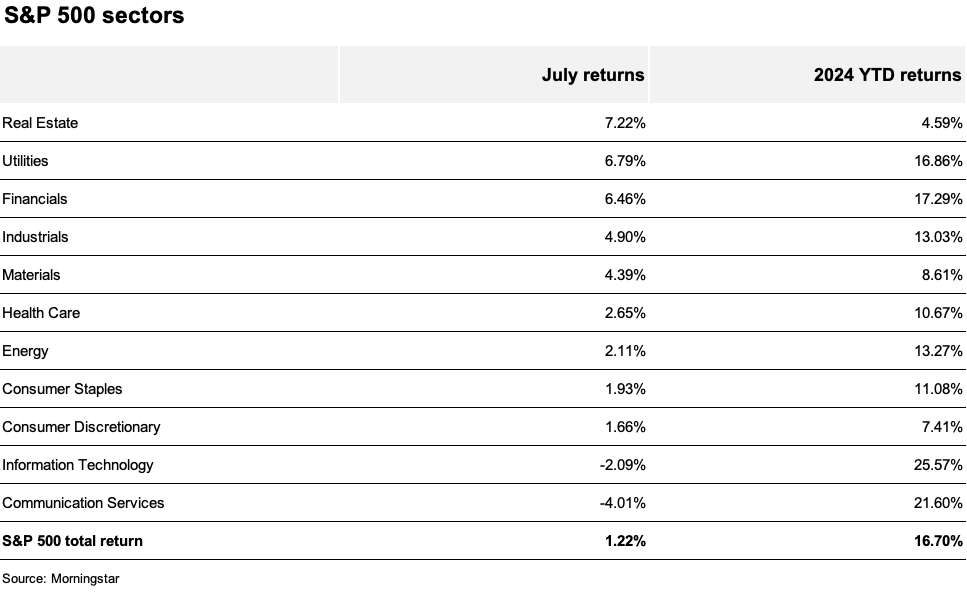

Although geopolitical uncertainty rose in July and domestic political news dominated headlines for much of the month, the U.S. stock and bond markets were generally focused on the country’s economic outlook. For the most part, the news was supportive: Retail sales remained robust, boosting confidence in the strength of the consumer, and second quarter gross domestic product (GDP) was reported at 2.8%—significantly above both the first quarter’s 1.4% gain and investor expectations. Even inflation fell more than the market expected, with the year-on-year Core Consumer Price Index (CPI) rising 3.3%, the smallest increase since April 2021.

But after reaching a new all-time high on July 16, the S&P 500® Index began a slide that gathered increasing momentum into early August. Economic data released late in the month was more mixed. For example, July manufacturing data slumped for the fourth consecutive month, according to the Institute of Supply Management (ISM), and earnings stumbles by select mega-cap companies began to raise questions about the size of their investment in artificial intelligence (AI) infrastructure. Microsoft Corporation, one of the leaders in AI spending, reported slowing growth in its cloud-computing business while simultaneously forecasting heavy spending on data center investment. Similarly, Alphabet Inc. reported sharply higher costs, while Amazon.com missed its revenue targets and provided disappointing guidance.

If questionable earnings, mixed economic data and geopolitical headlines were a few snowballs starting to roll downhill, it was July’s employment report (released on August 2) that saw them merge into an avalanche. While the employment data was weaker (new jobs created were low at 114,000, well below expectations, and the unemployment rate rose) the market’s severe reaction suggests the data may be the proverbial straw that broke the camel’s back as concerns over a slowing economy increased.

The shift in sentiment was dramatic and stock and bond market volatility surged into August. By the end of July, the CBOE Volatility Index® (VIX®), a common measure of equity volatility and sometimes nicknamed “the fear index,” had risen by nearly 50%, setting a new three-month high. The rapid spike in volatility continued to escalate through early August. In capital markets, concerns heightened that the U.S. Federal Reserve (Fed) was now behind the curve, and would have to cut interest rates three to four times in the remainder of the year, possibly with one unusually large 50 basis point cut. Two-year and 10-year U.S. Treasury yields dived through their year-to-date lows.

Outlook: Recent economic data and the market’s reaction have elevated the risks to our base-case scenario that the U.S. economy will achieve a soft landing. We have long cautioned that economic turning points can be volatile, and have recently recommended investors maintain a more cautious positioning, favoring high-quality assets in both stocks and bonds given the recent more mixed economic signals. We also noted that these more volatile environments can provide relatively attractive investment entry points in the event markets correct.

Markets have done more than a simple or orderly correction. The benchmark Japanese stock index, the Nikkei 225 Index, fell more than 12% on the evening of August 4—a move echoing the volatility of its 1987 collapse. The sharp decline’s proximate trigger was a rapid strengthening of the Japanese yen related to rising Japanese interest rates and increasing expectations that the Fed will cut its target rate deeper and more quickly. In the U.S., the VIX has touched levels not seen since the onset of the global pandemic, when it peaked around 75. Meanwhile, benchmark 10-year Treasury bonds have seen their yields collapse from near 4.3% on July 24 to well under 4% in early August..

While we believe a market correction in the current environment is both reasonable and healthy, the current volatility is extreme, fueled in part by the unwinding of positioning from leveraged investors. In our view, mixed economic data, uncertainty about the path of interest rates and concerns about geopolitical risks all warrant caution.

The VIX is currently signaling that uncertainty is akin to the onset of the global pandemic. In the last 25 years, the VIX has reached the August 5 (intra-day) levels only three times before: The COVID-19 pandemic, the global financial crisis and the dot-com burst. While we do have some concerns about the outlook for the U.S. economy, we continue to believe investors are better served by focusing on the long-term fundamental outlook, and by staying invested in the market with positioning around neutral in terms of risk tolerance, such as holdings of equities versus fixed income. Additionally, we expect U.S. Treasury bonds to serve as a counterbalance to any further decline in equities, as we believe additional economic and market weakness is likely to drive interest rates lower and bond prices higher. Furthermore, we believe in active management and recommend increasing or decreasing risk on the margin as the outlook evolves and potential opportunities arise.

Our expectation is that market volatility likely will continue through the remainder of the year. What could dampen the volatility? Confirmation that, while the economy has slowed, growth continues; the start of a rate easing cycle by the Fed; and healthy corporate earnings reports. Also, it’s important to remember that while the economy is slowing, it’s still growing.

Nevertheless, we understand that tolerating high volatility can be stressful, even for those holding a balanced portfolio of stocks and bonds, and thus encourage investors to reach out to their financial professionals if they have questions or concerns.