The downside of market timing

Let’s start with a definition. Market timing is the act of moving money in and out of the financial markets or switching between mutual fund asset classes, while trying to predict the future direction of the market. In other words, it involves making a series of decisions based on an endless cycle of volatile market and economic conditions.

Before giving in to the lure of market timing, here are some of the important factors to consider:

- Even if you sell your shares at the market’s peak, your good fortune is quickly put into question again when you try to guess the exact right time to reenter the market.

- Market timing is a tedious, time-consuming and imperfect pursuit that has no guarantee of success in the long run.

- When you time the market, you’re betting against experienced market analysts who are also trying to make timely buying and selling decisions in an attempt to beat market averages. Yet even with all their experience and resources, those analysts can get it wrong.

Another way to deal with market volatility

Volatility in the market often tests the resolve of investors. The more volatile the market, the more likely investors are to shed their stocks and head to the sidelines. However, you should keep this in mind:

- Volatility is normal in an active market.

- If you’re a long-term investor with a timeline of 10 years or more, many studies show that selling your stocks or mutual funds during a volatile period may have a negative impact on your long-term returns.

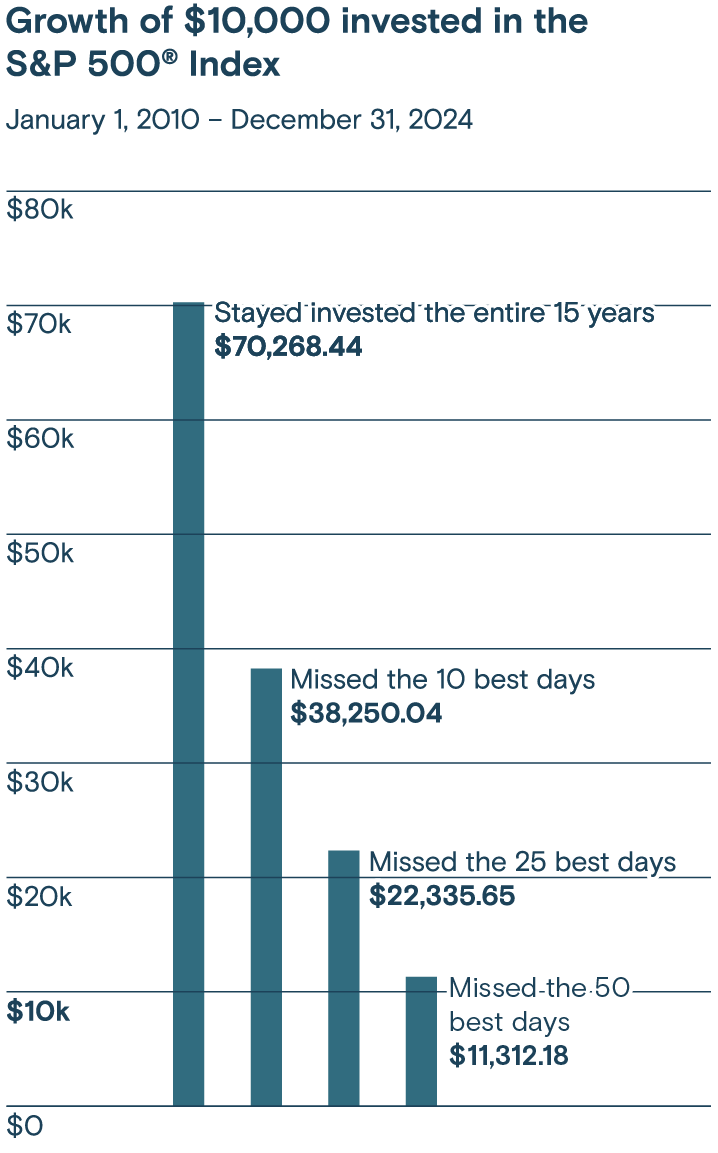

- While it’s easy to get out of the market when things seem to be heading south, it’s also very easy to miss the best performing days by not getting back in at just the right time. And if you miss those good days, your performance will likely be much worse than if you had simply stayed in the market the whole time.

![January 2026 Thrivent market & economic update [VIDEO]](/content/dam/thrivent/mcs/site-media/insights/market-update/2026-q1-thrivent-market-and-economic-update/2026-q1-group-thumbnail.png/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)