Prioritize needs and debts

In addition to investing, make sure you address pressing financial issues with your money. Some important actions to consider once your windfall arrives:

1. Make sure taxes are paid or accounted for before spending. Although an inheritance or life insurance check may come tax-free, a bonus check or a lottery ticket typically comes with a hefty tax bill.

2. Pay off high interest debt. If you have credit card debt that carries a high interest rate, paying down the debt should be a top priority.

3. Do something fun now—and later. Whether it’s a newer car, a Caribbean cruise, a wardrobe upgrade or a household remodel, pick one and enjoy it.

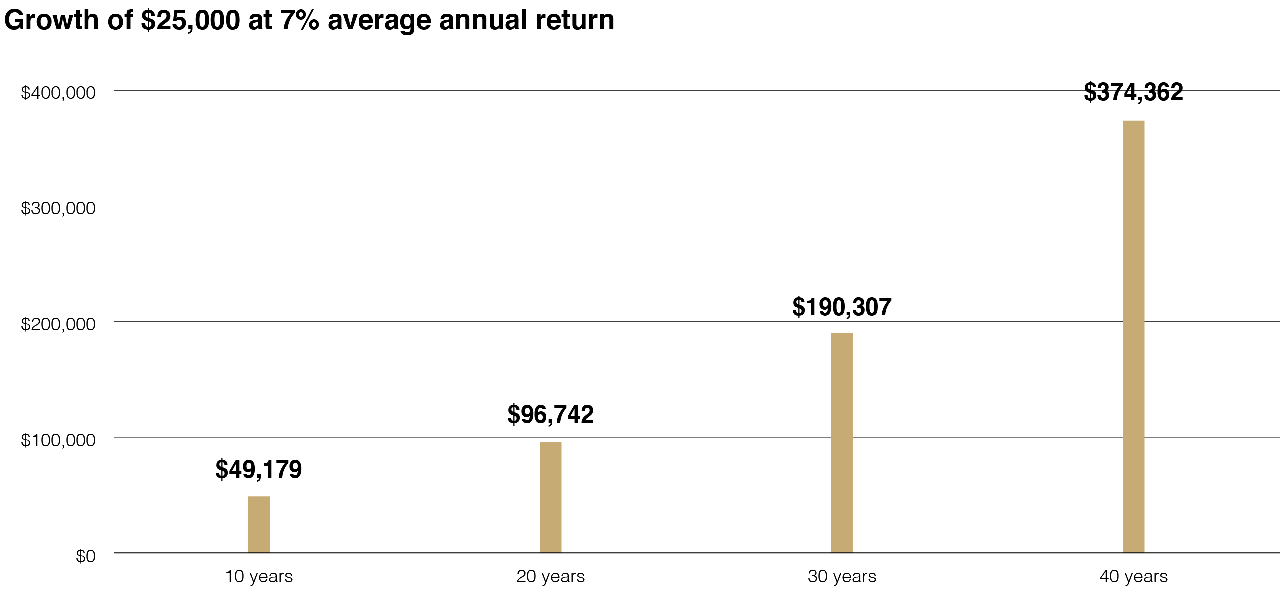

4. Invest in tax-favored investment accounts. Consider converting a large sum to tax-favored investments. That means maxing your 401(k) at work and IRA contributions. (Learn more about this topic: Maximizing your IRA could lower your taxes and pump up your savings)

5. Fund an education savings plan for your kids or grandkids. The money in a 529 or Coverdell college savings plan grows tax-deferred and can be withdrawn tax-free if used for qualified educational expenses.

6. Set aside a reasonable amount for your favorite cause or charity. If you’re passionate about a nonprofit organization, this may be a good opportunity to contribute to it.

7. Pay down student loan debt. This will help reduce your monthly burden. Or you could pay it off entirely if your windfall was substantial.

8. Pay off your mortgage. Paying off a house may put you in a better financial situation for the future. Depending on your mortgage rate, you may want to consider if paying off your mortgage is the best option. Depending on stock market performance, you should assess where your money can work the hardest for you. By paying off your mortgage, you also lose the potential for an annual interest rate deduction on your taxes.

9. Prepare an estate plan. Consider setting up or updating an estate plan. That way, you can be certain your money passes to your heirs as you choose. While an estate plan is a fairly complex document that may take many hours to prepare for you and your attorney, it can save your loved ones a great deal of time and trouble after you’re gone.

10. Connect with a financial professional. If you’ve won the lottery or inherited a large sum, you may want to consult with an accountant, an attorney or a financial professional to help you manage your money.

You have many options and strategies for managing a windfall. The key is to think beyond the moment and invest as much as possible to enhance your life for many years to come.