Start with goals and risk

Before diving into fund performance, you should first have a clear sense of your financial goals and risk tolerance. Once you know what you’re saving for, when you’ll need the money and how comfortable you are with different levels of fluctuation in your account values, you can more easily narrow your choices. Most funds will provide a statement of investment objective and the relative risk of the fund when compared to other funds. These two pieces of information may provide you with enough information to know if a fund is in line with your needs. Once you find a fund that seems to match your goals and risk tolerance, the next step is to take a deeper look at the fund performance.

Mutual fund performance indicators

Here are some of the typical values used to determine fund performance:

Net asset value (NAV)

The NAV is the fund’s value or price per share. The NAV is calculated by dividing the total value of all the fund’s assets (minus its liabilities) by the number of shares issued. NAVs are only calculated once per day, after the market has closed.

Daily NAV change

Since mutual funds are only priced once a day, the daily NAV change is the difference between the fund’s most recent price per share and its price from the prior day. The daily NAV change can be shown as a dollars-and-cents change or a percentage change.

Returns

Mutual fund performance is usually presented as a total return. Total returns include both the fund’s change in value and the reinvestment of any dividends, capital gains or interest payments.

Average annualized or trailing returns

Average annualized returns, also known as trailing returns, illustrate fund performance over a specific time period, usually looking backward from a recent month or quarter-end. The most common time periods include three months, year-to-date, 1 year, 3 year, 5 year, 10 year and since inception.

Calendar year returns

Mutual funds will also often show calendar year returns which illustrate how a fund performed from January 1 to December 31 of that particular year. This allows you to see how the fund performed during specific historical time periods.

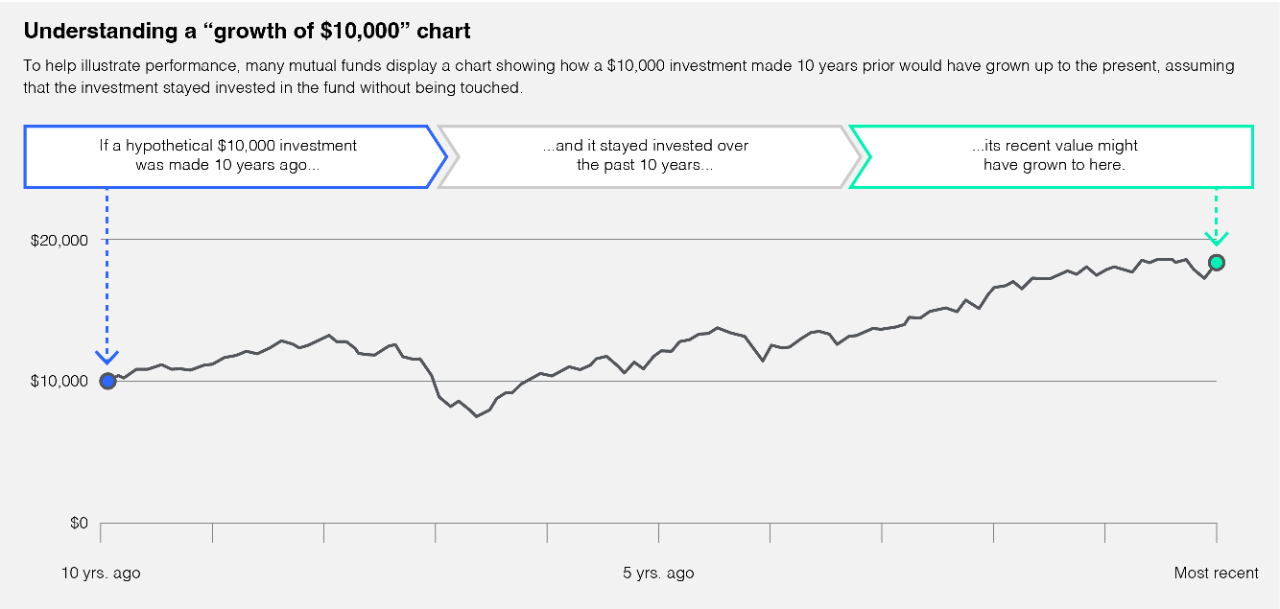

Growth of a $10,000 investment

Below is an example of a chart many mutual funds present to demonstrate how a $10,000 investment in that fund would’ve changed over time. These charts typically go back either 10 years or back to the initial launch of the fund.