When markets decline, the last thing many of us want to do is continue investing in them. But rather than being scared by market volatility, take advantage of it with a strategy called dollar cost averaging.

What is dollar cost averaging?

Dollar cost averaging involves making regular investments of a fixed amount over a period of time. Instead of attempting to time the market, you buy in at a range of different prices.

If you contribute regularly to a 401(k) or other retirement account through payroll deductions, you’re already utilizing this strategy.

How dollar cost averaging works

With dollar cost averaging, you invest a set dollar amount in a fund (typically through broadly diversified mutual funds) on a consistent basis—no matter where the market stands or how great the volatility. This helps eliminate one of the most worrisome aspects of investing: trying to determine the best time to invest.

The beauty of this strategy is that it requires no effort or expertise on your part. Yet despite volatile markets, it may help you improve your long-term returns by buying more shares when the market is down and fewer shares when it’s up.

There are limits, of course. While a dollar cost averaging strategy is helped by a market that is trending upward, it likely won’t improve the performance of an investment that continues to fall in value. (Periodic investment plans do not ensure a profit or protect against a loss in a declining market).

Dollar cost averaging in action

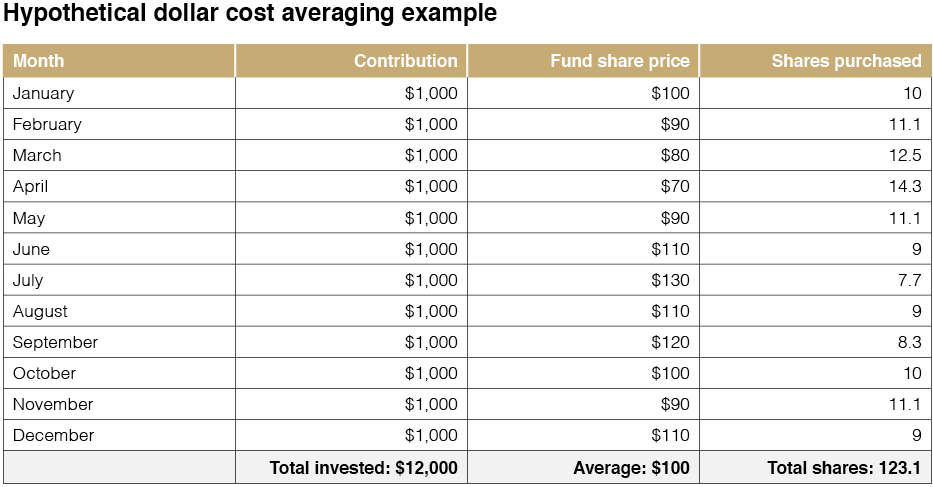

The basis of dollar cost averaging is simple mathematics. When you invest a set amount each month, that static dollar amount buys more shares when the market prices are low and fewer when prices are high.

In a market that is upwardly trending, the shares you bought at below average prices may help tilt your long-term performance slightly higher.

The chart below gives a hypothetical example of how this could happen.