All information and representations herein are as of 10/07/2025, unless otherwise noted.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Thrivent Asset Management, LLC associates. Actual investment decisions made by Thrivent Asset Management, LLC will not necessarily reflect the views expressed. This information should not be considered investment advice or a recommendation of any particular security, strategy or product. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon, and risk tolerance.

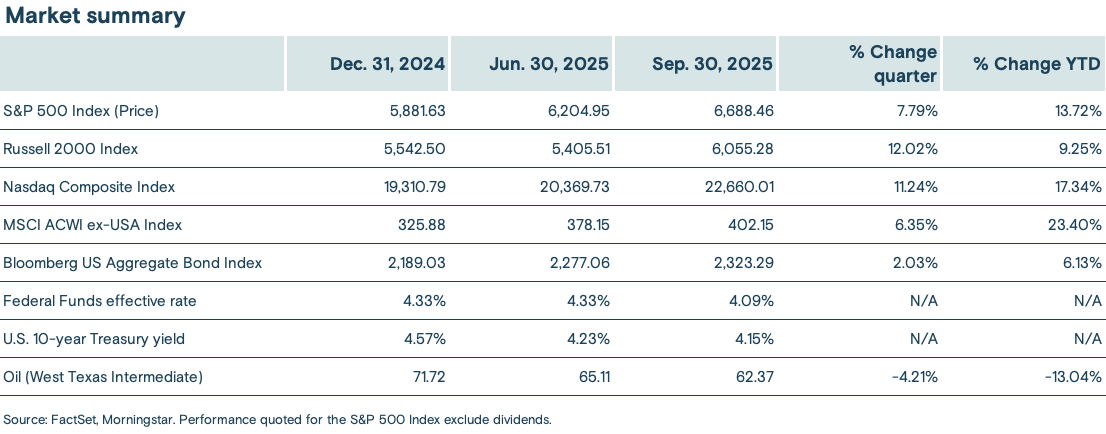

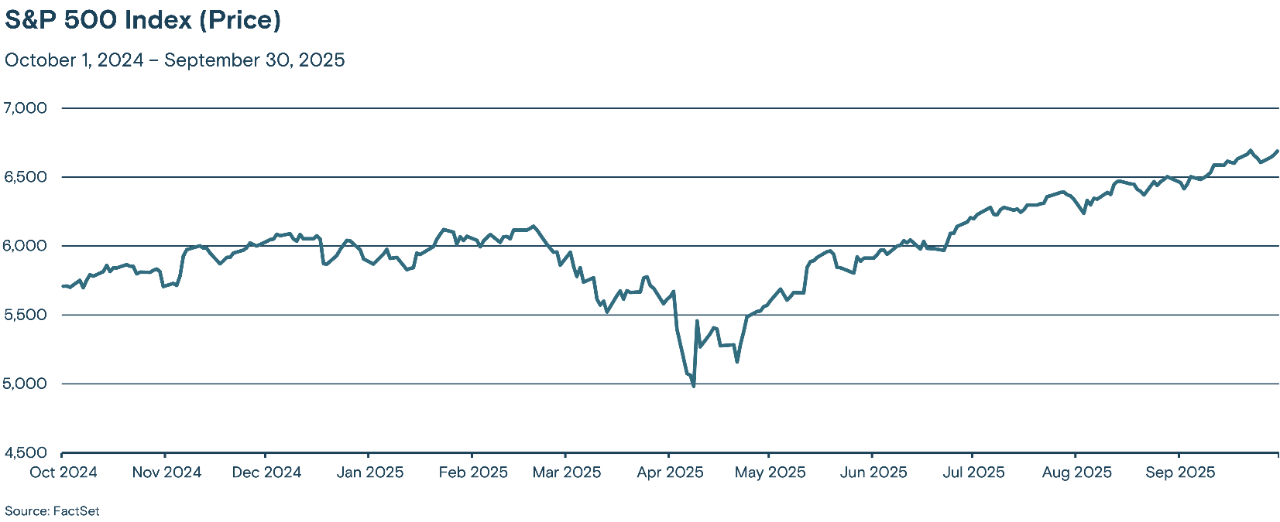

The S&P 500® Index is a market-cap weighted index that represents the average performance of a group of 500 large-capitalization stocks.

The Russell 2000® Index is an unmanaged index considered representative of small-cap stocks.

The Nasdaq Composite Index is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. The Nasdaq – National Association of Securities Dealers Automated Quotations – is an electronic stock exchange with more than 3,300 company listings.

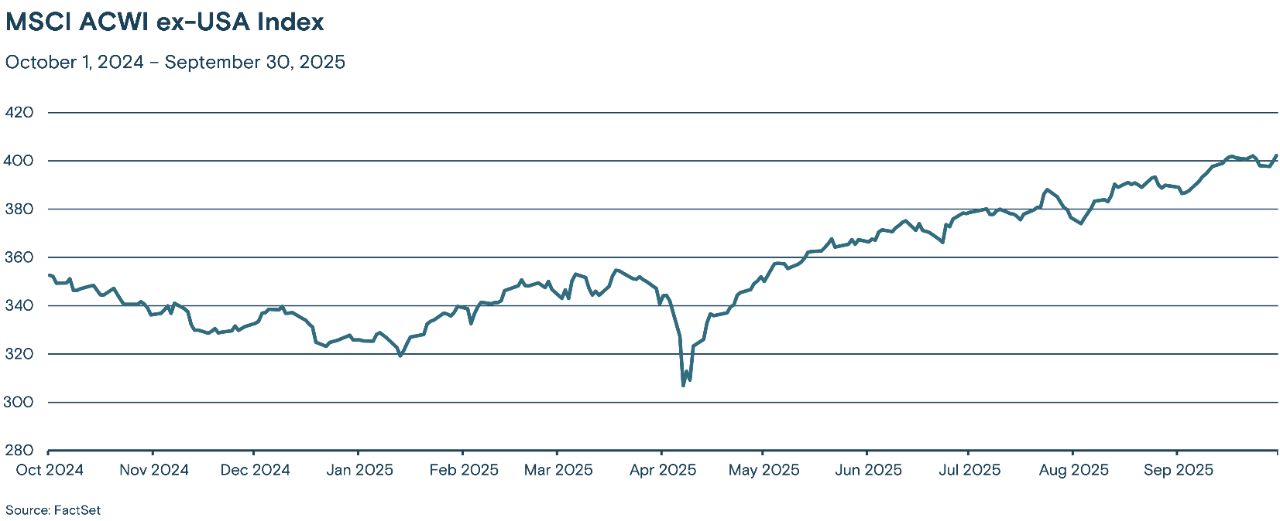

The MSCI ACWI ex-USA Index is an unmanaged index considered representative of large- and mid-cap stocks across developed and emerging markets, excluding the U.S.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index considered representative of the U.S. investment-grade, fixed-rate bond market.

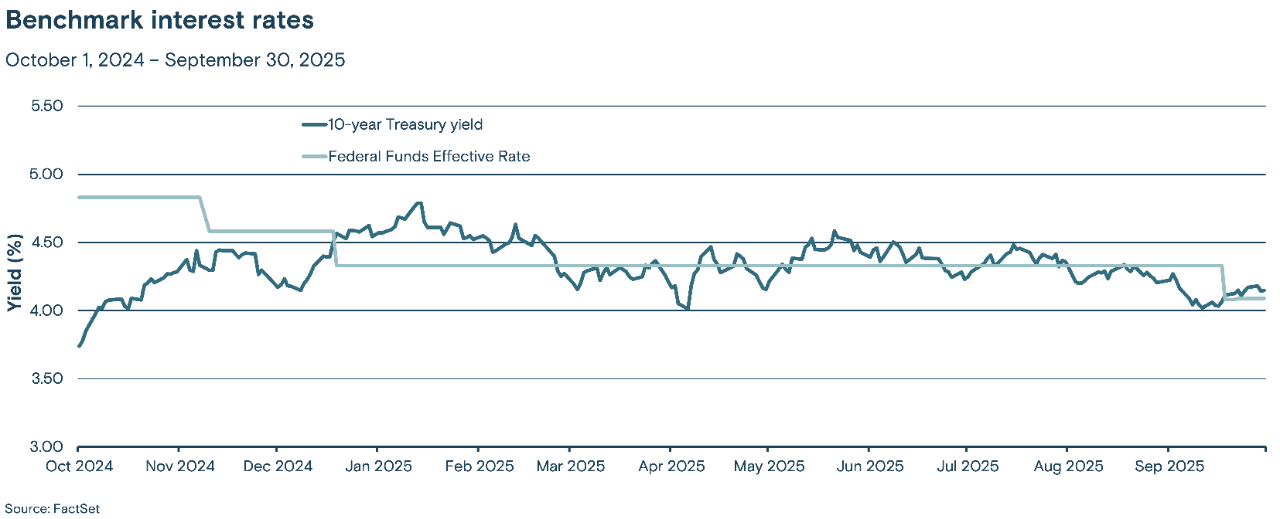

The Federal Funds effective rate is the interest rate at which depository institutions (mainly banks) lend reserve balances to other depository institutions overnight on an uncollateralized basis. In simpler terms, it's the rate banks charge each other for short-term loans to meet their reserve requirements.

The Institute for Supply Management (ISM) survey is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at manufacturing firms nationwide.

The Consumer Price Index measures the monthly change in prices paid by U.S. consumers for a basket of goods and services.

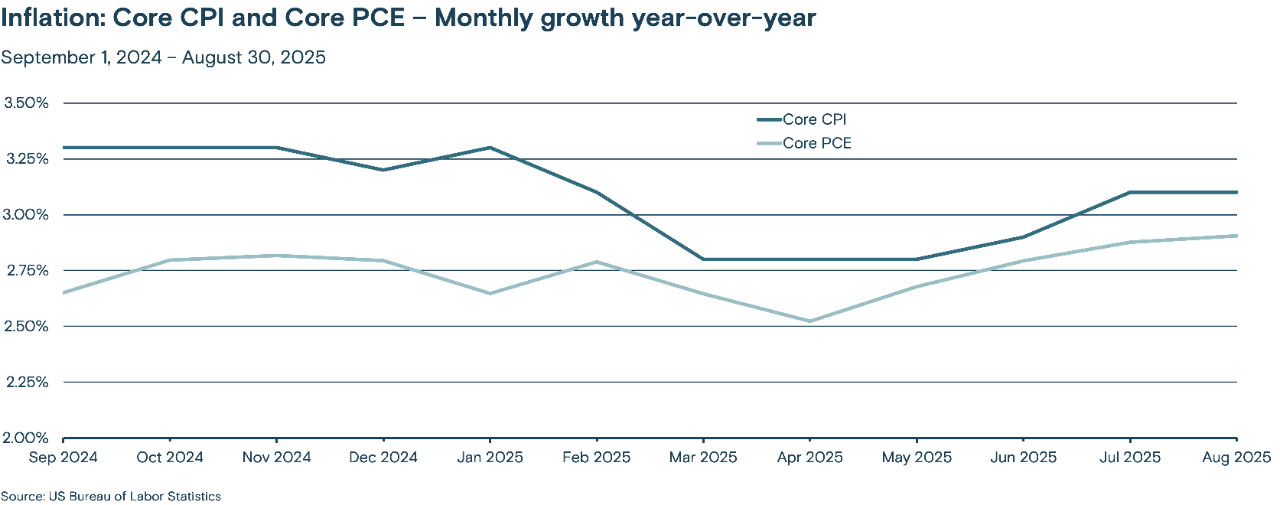

The Core Consumer Price Index (CPI) measures changes in the prices of goods and services, with the exclusion of food and energy.

The Core Personal Consumption Expenditures (PCE) Price Index, also known as consumer spending, is a measure of the spending on goods and services, excluding food and energy prices, by people of the U.S.

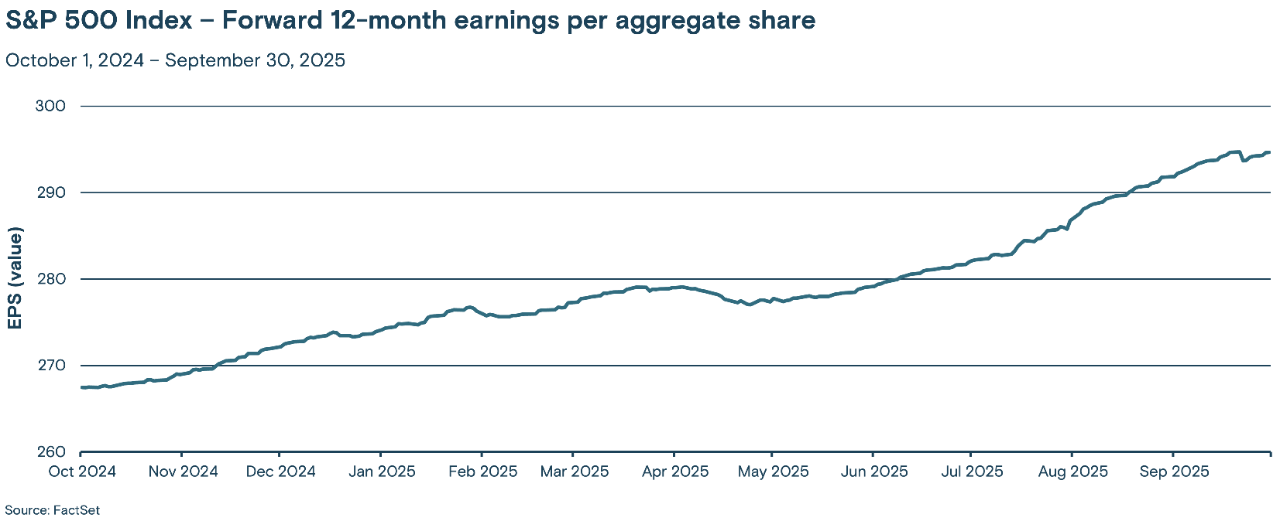

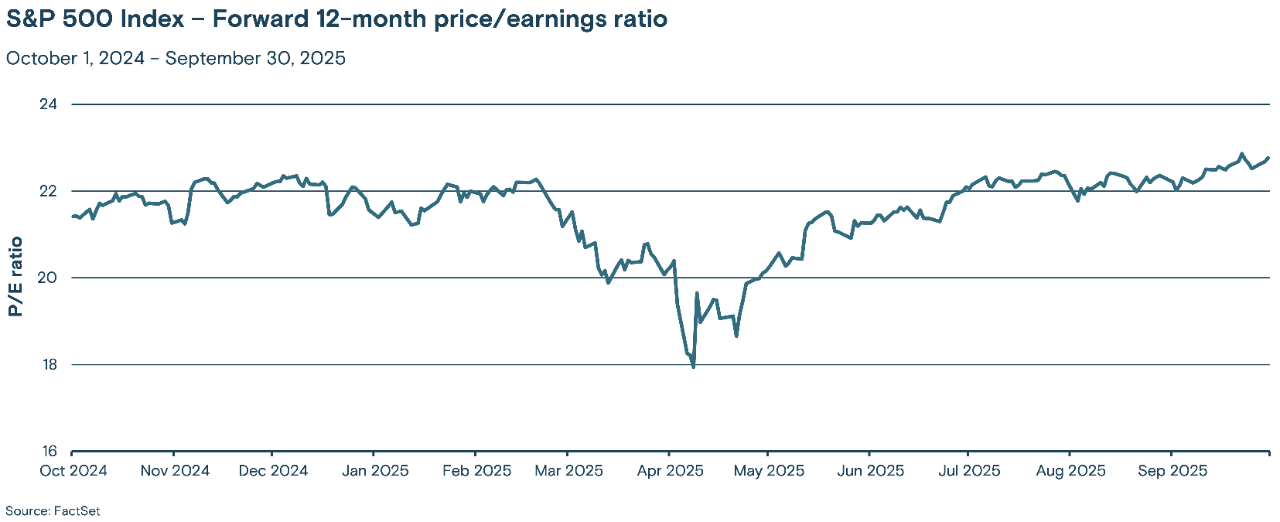

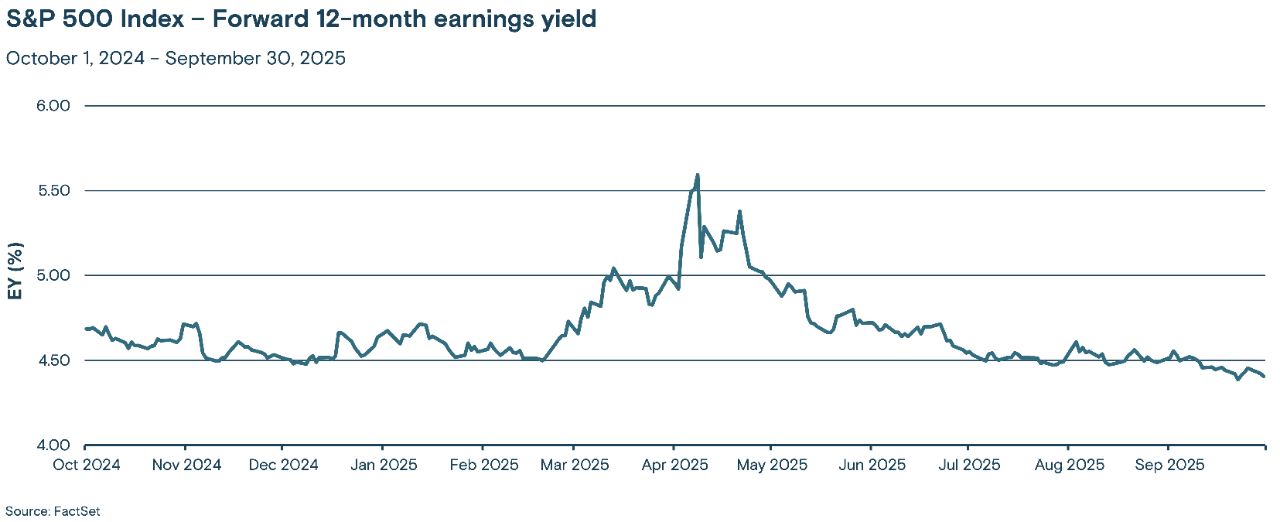

The forward PE ratio uses the forecasted earnings per share of the company over the next 12 months for calculating the price-earnings ratio. It is calculated by dividing the price per share by forecasted earnings per share over the next 12 months.

Earnings yield is the 12-month earnings divided by the share price. Earnings yield is the inverse of the P/E ratio. Earnings yield is one indication of value; a low ratio may indicate an overvalued stock, or a high value may indicate an undervalued stock.

The Nominal Trade-weighted U.S. Dollar Index measures the value of the U.S. dollar based on its competitiveness versus trading partners.

Any indexes shown are unmanaged and do not reflect the typical costs of investing. Investors cannot invest directly in an index.

For more information on the index providers and their disclaimers, visit www.thriventfunds.com/privacy-and-security/index-provider-notices.html.

Past performance is not necessarily indicative of future results.

![January 2026 Thrivent market & economic update [VIDEO]](/content/dam/thrivent/mcs/site-media/insights/market-update/2026-q1-thrivent-market-and-economic-update/2026-q1-group-thumbnail.png/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)